UK private sector growth hits six-month high

UK private sector output growth has climbed to a six-month high. in March, in a pre-Spring Statement boost for chancellor Rachel Reeves.

While British manufacturing output is sliding this month, the services sector is growing at a faster rate.

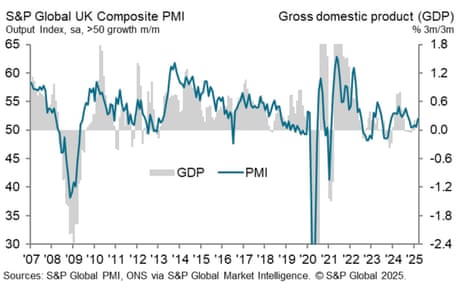

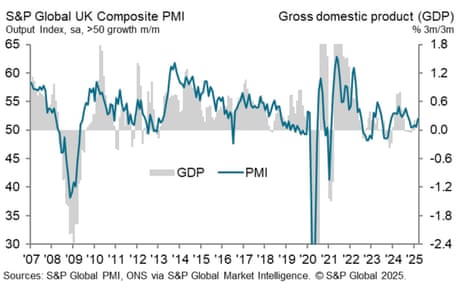

This services rebound has lifted the UK PMI Composite Output Index, which tracks activity in the economy, up to 52.0, the highest since last September, up from 50.5 in February.

S&P Global, which compiles the PMI report, says that service sector growth was bolstered by renewed improvements in both domestic and overseas sales.

But manufacturers were hit by “severe headwinds”, including rising global economic uncertainty and potential US tariffs.

The report says:

Weak international demand resulted in the fastest decline in manufacturing export sales since August 2023. Moreover, manufacturers reported the steepest downturn in production volumes for nearly one-and-a half years.

Here are the details:

-

Flash UK PMI Composite Output Index: 52.0 (Feb: 50.5). 6-month high.

-

Flash UK Services PMI Business Activity Index: 53.2 (Feb: 51.0). 7-month high.

-

Flash UK Manufacturing Output Index: 44.6 (Feb: 47.3). 17-month low.

-

Flash UK Manufacturing PMI: 44.6 (Feb: 46.9). 18- month low.

The report also shows that private sector employment is fallling in March for the sixth month running.

Companies cited business restructuring, investments in automation and the non-replacement of leavers in response to rising payroll costs – a sign that Reeves’s increase to employers’ national insurance rates, and the minimum wage, is hitting workforce levels.

Chris Williamson, chief business economist at S&P Global Market Intelligence said:

“An upturn in business activity in March brings some good news for the government ahead of the Chancellor’s Spring Statement, offering a respite from the recent flow of predominantly downbeat economic data. However, just as one swallow does not a summer make, one good PMI doesn’t signal a recovery.

The signal from the flash PMI is an economy eking out a modest expansion in March, consistent with quarterly GDP growth of just 0.1%, but with employment continuing to be cut thanks to concern over costs and the uncertain outlook. Confidence is still running close to January’s two-year low.

Williamson cautions that the improvement is also being driven by only small pockets of growth, notably in financial services, with consumer-facing business and manufacturers continuing to struggle against headwinds both at home and abroad.

He adds:

These headwinds include the additional costs imposed on businesses in the Budget, low confidence among businesses and households, and sluggish demand at home and abroad, the latter linked to heightened geopolitical uncertainty resulting from US tariff policies.

Worryingly, these headwinds are likely to grow in force as higher National Insurance contributions come into effect in April, coinciding with the anticipated review of US tariff policy on 2nd April, the latter having the potential to further subdue global economic growth and dampen UK trade.”

Key events

Eurozone manufacturing returns to growth

Happy news: the eurozone’s factory sector has returned to growth this month, perhaps thanks to a rush to beat new US tariffs.

S&P Global’s poll of purchasing managers from across Europe’s private sector has found that manufacturing production has increased for the first time in two years, even though new orders fell again.

Here’s the details (where any reading over 50 shows growth):

-

HCOB Flash Eurozone Composite PMI Output Index at 50.4 (February: 50.2). 7-month high.

-

HCOB Flash Eurozone Services PMI Business Activity Index at 50.4 (February: 50.6). 4-month low.

-

HCOB Flash Eurozone Manufacturing PMI Output Index at 50.7 (February: 48.9). 34-month high.

-

HCOB Flash Eurozone Manufacturing PMI at 48.7 (February: 47.6). 26-month high

Dr. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, says:

“Just in time with the beginning of spring we may see the first green shoots in manufacturing. While we should not be carried away by a single data point, it is noteworthy that manufacturers expanded their output for the first time since March 2023. It’s also encouraging, that the index output has risen for three months straight. This is complemented by a much softer fall in new orders and employment.

One could pour some cold water on this development arguing that it’s the temporary tariff-related import boom from the US which has driven the improvement in manufacturing. However, given the will of Europe, to invest heavily in defense and infrastructure – in Germany a corresponding historical fiscal package has been approved only last week – hope for a more sustained recovery seems well founded.

The price development in the services sector, which is very much under scrutiny of the ECB, will be well received by the doves of the monetary authority. Both input costs and selling prices are rising at a slower pace compared to recent months.

Lower input cost inflation points to less pressure from wages which are a key ingredient of input costs in the labour intensive services sector. Meanwhile, in manufacturing, price increases for both selling and purchasing remain moderate, helped along by declining energy costs.

Japan’s private sector output falling

Japan’s private sector output is falling this month for the first time since last October, a new poll has found, and at the fastest rate in three years.

The latest poll of purchasing managers at Japanese companies shows that manufacturers were hit by worsening demand, while services companies suffered from labour constraints

Overall new orders fell for the first time in nine months, while sales in March were notably also dampened by elevated prices.

Poll: Investors still hope Trump will be softer than his campaign pledges on trade

Investors are more concerned than three months ago about the threat from Donald Trump’s trade war, a new poll by Deutsche Bank has found.

The survey of 400 people found that the perceived tariff risk has gone up so far this year.

On a scale of 0 to 10, where 0 means ‘No additional tariffs’ and 10 means ‘An extreme tariff regime’, 38% of those who took part in the poll plumped for at least 7 – a level that would mean Trump delivering on his pledges during the election campaign.

That’s up from 18% who chose 7, 8, 9 or 10 in December.

It still means that 62% of respondents reckon Trump will put in sustained tariffs that are softer than his campaign pledges.

Deutsche’s global markets survey polled financial professionals from around the world, and also found:

-

European equities are aggressively favoured over the US over the next 12 months but over 5 years this flips back heavily in the US’s favour. So US exceptionalism is expect to return after a continued lull in 2025.

-

Germany is expected to grow at 1.2% on average over the next 5 years with a peak 10yr Bund rate of 3.7% over this period.

-

The US recession risk over the next 12 months is seen at 43% on average but the distribution of responses was very wide.

-

A surprisingly huge majority think this US administration actively want a weaker dollar.

Digital marketing group S4 has warned that concerns over tariffs are making its clients cautious.

Sir Martin Sorrell, executive chairman of S4, told shareholders that the company is facing challenging global macroeconomic conditions and continued high interest rates.

Sorrrell added:

The macroeconomic environment in 2025 will remain challenging given significant volatility and uncertainty in global economic policy, particularly tariffs.

In geopolitics, US/China relations, Russia/Ukraine and Iran remain volatile issues and therefore clients are likely to remain cautious.

S4 reported an 11% fall in like-for-like net revenues for 2024.

It has also taken a Non-cash impairment charge net of tax of £280m, due to “trading conditions in the second half of 2024 and the medium-term outlook”.

That pushed it into a loss for the year of £306.9m, compared with a £14.3m loss in 2023.

European stock markets are up across the board.

Germany’s DAX has gained 0.85%, while France’s CAC is up 0.8% and Italy’s FTSE MIB is 0.66% higher.

FTSE 100 jumps at the open

Stocks have opened higher in London, lifted by those hopes that Donald Trump will show flexibility when he announces new global tariffs next month.

The FTSE 100 share index is up 0.5%, or 42 points, at 8688 points, which recovers most of Friday’s losses.

Mining stocks are leading the rally, with Anglo American (+3.9%), Antofagasta (+3.3%), Glencore (+3%) and Rio Tinto (+2.5%), benefitting from hopes that ‘Liberation Day” might be less damaging to the world economy than feared.

A sector upgrade by JP Morgan is also helping the miners.

Heathrow and National Grid trade power claims

A war of words has broken out between Heathrow and National Grid over the fire which brought the London airport to a standstill on Friday.

The chief executive of National Grid sparked the row by claiming that Heathrow Airport had enough power from other substations despite Friday’s shutdown.

Following criticism that the power network lacked resilience to cope with the fire at one substation, at North Hyde, John Pettigrew has revealed that two other substations were “always available for the distribution network companies and Heathrow to take power”.

Pettigrew told the Financial Times:

“There was no lack of capacity from the substations. Each substation individually can provide enough power to Heathrow.”

But Heathrow, which had more than 1,000 flights cancelled on Friday, insists it’s not as simple as that.

A Heathrow spokesperson says:

“As the National Grid’s chief executive, John Pettigrew, noted, he has never seen a transformer failure like this in his 30 years in the industry. His view confirms that this was an unprecedented incident and that it would not have been possible for Heathrow to operate uninterrupted. Hundreds of critical systems across the airport were required to be safely powered down and then safely and systematically rebooted. Given Heathrow’s size and operational complexity, safely restarting operations after a disruption of this magnitude was a significant challenge.

In line with our airline partners, our objective was to reopen as soon as safely and practically possible after the fire. The emergency services and hundreds of airport colleagues worked tirelessly throughout Friday to ensure the safe reopening of the airport. Their success meant that over the weekend, we were able to focus on operating a full schedule of over 2500 flights and serving over 400,000 passengers.

Lessons can and will be learned, which is why we fully support the independent investigation announced by the Government yesterday.”

Starmer is warned against ‘appeasing’ Trump with tax cut for US tech firms

Rowena Mason

Keir Starmer has been warned against “appeasing” Donald Trump as he considers reducing a major tax for US tech companies while cutting disability benefits and public sector jobs.

His chancellor, Rachel Reeves, confirmed on Sunday that there were “ongoing” discussions about the UK’s £1bn-a-year digital services tax that affects companies including Meta and Amazon.

She expressed optimism that Trump’s 25% tariffs on British steel could be removed in any deal, but did not deny there could be changes to the digital services tax, which the US has lobbied against. “You’ve got to get the balance right,” she said.

While any changes would not take place in this week’s spring statement, the Liberal Democrats warned Labour was “in danger of losing its moral compass” and it would be “tantamount to robbing disabled people to appease [Elon] Musk and Trump”.

Even if the Trump White House takes a more ‘flexible’ and targeted approach, “Liberation Day’ is likely to bring in steep new trading barriers at the US border.

Stephen Innes, managing partner at SPI Asset Management, explains:

U.S. equity futures caught a bid in early Asia trading as markets latched onto signs that the next round of Trump-era tariffs may be more calibrated than initially feared. While the White House is still moving ahead with its April 2 “Liberation Day” deadline, the tone appears to be shifting—from a broad-based barrage to a more targeted, reciprocal framework.

According to sources close to the matter, the administration now plans to narrow its focus. It will apply tariffs to a group of nations dubbed the “dirty 15”—countries with persistent trade imbalances that collectively represent the lion’s share of U.S. imports. These nations will bear the brunt of the tariff hikes, while others could be hit with more modest levies.

The White House is reportedly easing back on industry-specific tariffs, such as those on autos, semiconductors, and pharmaceuticals. These tariffs had been expected to drop alongside the reciprocal action. For now, those sectoral tariffs may be shelved, although insiders note that planning remains fluid and subject to change.

Nonetheless, the administration’s April 2 tariff salvo could lift duties on the U.S.’s largest trading partners to levels not seen in decades. According to sources familiar with the planning, countries landing on the “dirty 15” list should brace for sharply higher, potentially punitive tariff rates, marking a dramatic escalation in the push for trade “reciprocity.” The message from Washington is clear: imbalanced trade comes with a price tag—and it’s about to go up.

US and European markets poised to open higher

Financial markets have made an optimistic start on Monday with U.S. stock futures rising and the dollar firm, Reuters reports.

S&P 500 futures are up about 0.7% in the Asia session and Nasdaq 100 futures have risen by 1%.

European futures were up 0.3% earlier today, with the UK’s FTSE 100 index on track to rise 0.25%.

Samer Hasn, senior market analyst at XS.com, says:

US stock indexes are poised for a positive opening amid optimism about the possibility of de-escalating trade tensions between the United States and China and moving toward negotiations. This could reduce the risk of a broader trade war after the two economic powers’ mutual escalation, which has caused uncertainty in the markets.

Republican Representative Steve Daines, a pro-Trump Republican, visited China and met with Premier Li Qiang on Sunday. This visit marks the first visit by a US political figure to China since Trump took office earlier this year. It also represents an important step that paves the way for the next meeting between the Chinese and US presidents, according to Daines.

Introduction: Hope of targeted approach to Trump’s ‘Liberation Day’

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

A new week begins with some familiar worries, as global markets brace for the US to intensify its trade war next month.

US President Donald Trump has declared April 2 will be “Liberation Day” for the US, when he will unveil so-called “reciprocal tariffs” on other countries who he perceives to be giving the US a bad deal on trade.

This has the potential to significantly widen the scope of the tariffs which Trump has been imposing on allies and rivals alike since returning to the White House.

But, hopes are building that the scope of Liberation Day be narrower than has been feared.

Late last week, Trump hinted that he could take a flexible approach. Speaking the Oval Office, he said:

“I don’t change. But the word flexibility is an important word. Sometimes it’s flexibility. So there’ll be flexibility, but basically it’s reciprocal.”

That has created some ambiguity, which optimistic investors may cling to.

White House offficials have told Bloomberg that some nations or blocs will be spared these reciprocal tariffs, and that – currently – Trump is not planning to announce separate, sectoral-specific tariffs at the Liberation Day event.

This could also cheer markets today, where stocks have been hurt in recent weeks by the threat of trade conflict, and fears of a US recession.

Last week, Treasury Secretary Scott Bessent said Trump’s reciprocal tariffs will focus on particular nations deemed most responsible for unfair commercial practices. He dubbed them the “dirty 15”, because these 15% of countries account for “a huge amount of our trading volume.”

Those practices could include non-tariff barriers including domestic-content production rules, testing regulations, or value-added tax (VAT) on sales to consumers.

Kathleen Brooks, research director at XTB, say the latest news regarding reciprocal tariffs is “mildly positive for risk sentiment” today.

She explains:

US and European equity futures are pointing to a stronger open as traders react to news that reciprocal tariffs will not be implemented all at once. The tariffs for April 2nd are now likely to be less sprawling and not a fully global event. They are also expected to exclude sector-specific tariffs on autos, pharma, and chip makers, which may spur some relief rallies later on Monday.

But is a delay to tariff announcements merely kicking the can down the road, rather than a softening in Trump’s approach to tariffs? There have been comments from officials this weekend, which suggests that tariffs will not be as bad as some expect, and they will only target countries that run large trade surpluses with the US.

We’ll also get the latest surveys of purchasing managers from across the US, the UK and the eurozone today, which may show the impact of tariff fears…

The agenda

-

9am GMT: Flash Eurozone PMI report for March

-

9.30am GMT: UK PMI report for March

-

12.30pm: United States Chicago Fed National Activity Index

-

1.45pm GMT: US PMI report for March