Market snapshot

- ASX 200 futures: +0.6% to 8,584 points

- Australian dollar: -0.02% at 65.43 US cents

- S&P 500: +0.8% to 6,141 points

- Nasdaq: +1% to 20,167 points

- FTSE: +0.2% to 8,735 points

- EuroStoxx: +0.1% to 537 points

- Spot gold: -0.2% to $US3,26/ounce

- Brent crude: +0.1% to $US67.75/barrel

- Iron ore: +0.1% to $US94.50/tonne

- Bitcoin: -0.2% to $US107,572

Price current around 7:10am AEST

Live updates on the major ASX indices:

🎥CBA most expensive bank in the world

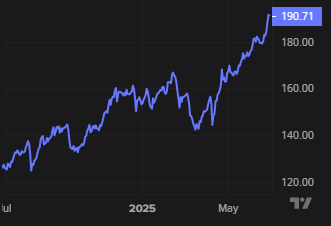

Commonwealth Bank shares closed at $190.71 yesterday, marking a 24 per cent gain since January 1.

Veteran banking analyst Brian Johnson joined Alicia Barry on The Business to talk what’s behind the seemingly unstoppable rally.

Mr Johnson, a senior research analyst at MST Financial, while he doesn’t think CBA is “worth” the share price, there is an explanation.

He says given CBA is such a large part of the ASX 200 (and Asia Pacific markets more broadly) funds that try to outperform the benchmark index, like superannuation funds, become net buyers of stocks as it rises.

“The more it goes up, if you’re underweight, the more you’ve got to buy, which means the more it goes up, which means the more you’ve got to buy.”

Watch the full interview here:

Loading…

Scott Bessent asks US Congress to drop ‘revenge tax’

In what’s being viewed with a sigh of relief from investors, US Treasury Secretary Scott Bessent has requested Congress remove the so-called “revenge tax” component of Donald Trump’s “Big, Beautiful Bill”.

Under Section 899 of the tax and spending bill, “retaliatory taxation” would have allowed the US government to hit companies and investors from countries imposing unfavourable taxes on US firms with a tax penalty of up to 20 per cent — a measure that had spooked Wall Street.

Now, Scott Bessent says G7 counties have struck a deal to exempt US companies from global minimum tax arrangements:

Chief business correspondent Ian Verrender had this analysis earlier this month on what the revenge tax provision could’ve meant for Australia and investors:

What’s weighing on the US dollar?

Commonwealth Bank analyst Carol Kong has put out her morning note, with some more context around what’s dragging down the US dollar.

She expects the Aussie dollar to be supported against the greenback as risk sentiment improves, and expectations rise that the Federal Reserve will cut interest rates sooner if there’s a new chair.

“The USD has been weighed down by a Wall Street Journal report that President Trump is considering announcing a successor to [Federal Open Market Committee] chair Powell by September or October,” she wrote.

His term doesn’t officially end until next May

“The sooner a replacement is announced for Powell, the sooner he could be perceived to be a ‘lame duck’.

“Such an outcome could introduce some volatility into financial markets if the nominee makes public comments markedly different to the current chair.

“For now, expectations President Trump will choose a more dovish chair will keep downward pressure on FOMC pricing and the USD. The Fed Funds futures market expects the next 25bp FOMC rate cut to be delivered in September.”

So how about the Aussie dollar? It’s good news for now but there are risk events looming,

“The expiration of the first ‘tariff pause’ that covers all imports except from China on 9 July is looming as a key downside risk to AUD/USD in our view,” Ms Kong noted.

“We consider AUD/USD is still vulnerable to a sharp drop around 9 July as it did in early April if President Trump reinstates unilateral tariffs.”

ASX poised to rise as Wall Street nears records

Good morning — we made it to Friday.

It looks like it could be a positive session on the local share market to end out the trading week, too. Futures are higher after the major US indices climbed overnight.

The S&P and Nasdaq neared record highs, while the US dollar index headed in the other direction.

That was good news for the local currency, with the Aussie dollar touching above 65.5 US cents overnight.

It came as speculation about a replacement for Federal Reserve chair Jerome Powell continued, amid ongoing criticism from US President Donald Trump, this week labelling him “terrible”.

Meanwhile, market pricing for an earlier interest rate cut by the Fed was on the rise.

Stick with us as we close out the week.

Loading