Market snapshot

ASX 200 futures: -0.2% to 8,264-points

Australian dollar: Up 0.3% to 66.81 US cents

S&P 500: +0.03% to 5,855 points

Nasdaq: +0.5% to 18,582 points

FTSE: -0.1% to 8,306 points

EuroStoxx: -0.04% to 4,939 points

Spot gold: +1% to $US2,747/ounce

Brent crude: +2% to $US75.77/barrel

Iron ore: -1.1% to $US100.70/tonne

Bitcoin: -0.1% to $US26,799

Prices current around 7:30am AEDT.

Live updates on the major ASX indices:

The Australians buying their first home later and retiring with a mortgage

In case you missed it on The Business last night:

We all love a chart

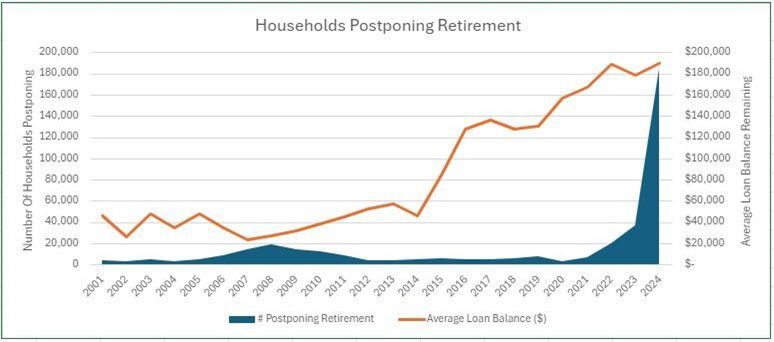

Here’s a great graph from Digital Finance Analytics very clearly showing the trend with retirees and mortgages:

Working for longer as mortgages bite

More and more Australians are facing retirement years with mortgage debt, according to census data.

Over the past 20 years, the number of Australians aged 55 to 64 who owned their homes outright had almost halved.

A survey by Digital Finance Analytics found about three-quarters of retirees with a mortgage owe more than they have in superannuation.

And that’s likely to put pressure on the Federal Government’s finances in the long run as more people rely on the age pension to get through their later years.

Read more by yours truly here:

GM, Philip Morris record strong earnings as Trump policies influence investors

Tom Piotrowski, senior market analyst at CommSec, spoke with ABC News Radio this morning about what’s happening in the northern hemisphere.

“We’ve seen contained performance. Sellers have tended to have a cautious approach as we move through the end of the week,” he said.

It’s reporting season in the USA and Mr Piotrowski says the looming US election is starting to have a larger effect on “the consciousness of investors”.

“US interest rates are at their highest level in 12 weeks as bond investors take stock of a potential Trump government. Trump is leading in the polls so interest rates are a bit more defensive.”

Last night General Motors had the most improved stock on the S&P 500, he said, after they recorded higher revenue than expected.

GM pointed towards a strong US consumer and its growing EV business moving towards profitability as key reasons behind its strong results.

Tobacco giant Philip Morris also recorded its results, up +9% beating expectations by a considerable margin, Mr Piotrowski said.

Good morning, good morning!

Hello and welcome to the Wednesday edition of the ABC finance blog,

Loading

Rachel Clayton from the ABC business unit will take you through the morning covering markets, business, finance and economics news.

The ASX 200 looks set to rise after a sharp fall yesterday, with the futures market tipping the index to lift +0.2% to 8,264-points.

That’s off the back of Wall Street recording its first consecutive decline in six weeks, followed by a rebound.

The blue-chip Dow Jones is up +%0.1% to 42,977-points. The broader S&P 500 is up ever so slightly +0.03% to 5,855-points while the tech-heavy Nasdaq lifted +0.5% to 18,582-points.

Any questions, thoughts or queries pop ’em in the comments!